Written By: garverm

Raleigh, NC, April 1, 2017 — In our work, in the financial services market, preparing institutions for measurements and reporting under the FASB’s CECL standard, the only common thread joining this rich tapestry of models, forecasts, and measurement elections seems to be an implicit assumption that an institution will choose to implement the standard on financial statements as of the latest possible reporting period. The standard, issued in ASU 326 (Financial Instruments – Credit Losses) in June of 2016, contains several timelines for required adoption of the standard depending on the type and existing reporting requirements of the financial institution. While the timelines are (directly) independent of institutional size and complexity, all financial institutions do have one thing in common:

For fiscal periods beginning after December 15, 2018, and for interim periods within those years, use of the CECL standard is permitted.

In other words, no matter the institution’s required timeline, early adoption is permitted. Here we examine the reasons why an institution would elect to adopt early.

Before we delve those reasons too deeply, at risk of uncovering dark forces better left alone, it is instructive to examine some key insights shared with us by our clients in the banking and credit union space. These insights from the third oldest profession are, for obvious reasons, sometimes paraphrased, and always non-attributable:

- “Good, we were wondering what to do with all this cheap bank capital” ($1.3B commercial bank); and

- “Sure was nice of the FASB to schedule this after I retire” (Multiple); and

- “The matching principle is a crusty holdover from the De Medici era. Good riddance!” ($500MM community bank); and, perhaps most colorfully

- “Even if I know I’m scheduled for execution on Friday at midnight, I’m unlikely to get it over with on Wednesday” ($3B Credit Union)

Having dispatched with those excellent arguments for delay, let us now examine the presumably equally compelling arguments for vigorous and timely action. As with all worthwhile matters, this set of rationales comes in three:

- Rationale I: Addition by Subtraction

- Rationale II: Clarity for Those Meddling Stakeholders

- Rationale III: Try It, You’ll Like It!

Rationale: Addition by Subtraction

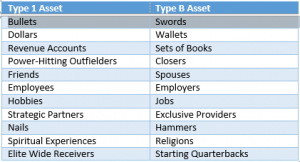

In keeping with the best practices of persuasive argument and thought leadership, we first construct an artificial binary, and then neatly divide the world into one side or the other. In this case, we consider “things that make you better off to have more of,” (Type 1 Assets) and “things that you want exactly one of at a time.” (Type B Assets). Typically, Type 1 assets are accumulative or replenishable/expendable. Type B assets are often limited by “exclusive deployment” characteristics. A comprehensive and exhaustive list based on decades of research is presented below.[1]

This rationale proposes that “Allowance Calculations” belongs in the Type B column. Having one is probably a good idea, having 0 is not an option, and having more than one begs far more questions than it answers. As long as one performs estimations under both standards, both efforts require energy, impact analysis, and attention. It’s not an option to mitigate this problem by setting a methodology for measurement, ignoring it until transition, and then cutting over and hoping for the best.

Rumblings and seismic activity under the Allowance Caldera of Mount Peecee’ayohbee have splashed a nontrivial amount of molten lava on the world’s audit and assurance professionals of late. While these hardworking and thoughtful people perform a vital and indispensable service to shareholders, we find in our field work they are also excellent conductors of heat. Given concerns with the fundamental model of Incurred Loss under present conditions (See Rationale III, below), institutions may quickly find themselves in a position where audit fees and an unresolvable tension between safety and soundness audiences and assurance audiences indicates a quick transition to a single model.

Financial institutions have long been borrowing wisdom from American hip-hop icons, and Rationale I is a simple formalization of the timeless wisdom first distilled by the late Notorious B.I.G., “Mo[re] [Compliance exercises pertaining to lost] Money, Mo[re] Problems”

Rationale: Clarity for those meddling stakeholders

Financial institutions compete on a number of fronts; they compete for depositors (historically speaking), borrowers, and they compete for capital.

One operating theory of capital markets and corporate governance proposes that investors love uncertainty, especially regarding future allocation of said capital to a balance sheet buffer zone. Similarly, one operating theory of quantum mechanics proposes that gravitational attraction is the result of “quantum elves” collecting all the universe’s matter for their waveform collapse brandy, to be uncorked at Ragnarok.

Other – presumably more sane – theorists believe that investors seek certainty. Under this theory, all other factors being equal, investors would demand less return on their capital from an institution with a specific, disclosed projection of future allocation than from an institution presenting that allocation as a magical mystery figure to be considered at a later date. Even better, under this theory, would be an institution presenting financial statements that already recorded this impact.

Shareholders and other stakeholders of institutions with credit loss exposure will want to know the balance sheet impact of the accounting change before the adoption of the accounting change. The specific lead time by which point such disclosure is expected or sought is beyond the predictive scope of this whitepaper or its author, but Rationale II holds that the curtailment of this “disclosed or discussed, but not recorded” period should be a consideration.

Rationale: Try it, you’ll like it!

Alluded to earlier, financial institutions with credit loss exposure are feeling two fundamentally irreconcilable pressures. Most conservative institutions primarily engaged in issuing loans secured by first liens on real property against demand deposits would find a to-the-letter-of-the-guidance reserve-to-loans level of about 30 basis points under present conditions. The silver standard of estimation in the industry is to average annualized loss rates over some period of time, usually twelve prior quarters. Increasing audit pressure in the market is to privilege that number, which represents a measurement of “probable and estimable” losses in the performing portfolio under current guidance.

“Thirty” basis points, to a safety and soundness audience, is a very peculiar way to spell and pronounce “One hundred”. And so, some tortuous (ideally, not tortious) mechanisms are produced to create qualitative policies to square the tension. Financial institutions are often left to decide which battle to fight – one against their auditors, who bill by the hour and are one third of the phrase “Audited financial statements”, or one against their examiners.

Further, current guidance precludes prediction. Last year, Jamie Dimon was forced to issue the best kind of financial statement footnote – the kind of footnote one screams from the rooftops of national television. When asked on CNBC about a doubling of Chase’s loan loss provision in light of declining oil prices, he responded: “If I could, I would have done more – but accounting rules are what they are … if I could I’d have put up another 300, 400 million, I don’t know.”[2]

Setting aside the chalking of $100MM to a rounding error, the concern is illustrative and one of the core motivators for the new guidance. The demolition of the wall between present and future puts the ‘E’ in CECL. Leaving quaint ideas like the “matching principle” to the wayside, the ‘C’ – current – requires institutions to perform more sophisticated measurements in their allowance estimation. One simply cannot arrive at a lifetime loss rate by averaging periodic loss rates; the use of appropriate methodologies to fulfill the ‘C’ and the ‘E’ in the new standard is inherently more rigorous. Many officers will find, having performed these estimation techniques, that there is little reason to further adjust them under many conditions.

The end result for many institutions will be a more considered, “craft” approach to the historical/numerical component of their allowance estimation that already factors in several of the common qualitative adjustments currently layered onto a rolling-average-lookback approach. This computational ballast, while onerous in transition, should lead to more defensible estimations that produce results that satisfy a safety and soundness audience as well as an assurance and audit audience. Rationale III maintains that these institutions will see the new standard as a way to resolve tensions under current guidance, provide more useful internal information in a broader risk management exercise, and move forward confidently now rather than with trepidation later.

The “try it, you’ll like it!” rationale for early adoption has an important corollary: “does Mikey like it?” Given the wide range of options for measurement under the standard and the amount of discretion involved, an intention of early adoption can be used to force the hands of external audiences. Rather than being backed into a practice by the market, early adopters can force these audiences to specificity on terms led by the institution, not their competitors.

Conclusions

To conclude on a serious note, we hope this examination of a few rationales for early adoption has been instructive; what began as an exasperated client instructing their audit firm “fine, we’ll just convert to CECL now” turned into a devil’s advocate exercise that led to some fascinating conversations and explorations under the cool glow of warming projector bulbs across the country. Of course, as a provider of allowance estimation software designed to implement several concurrent scenarios under both incurred-loss and CECL accounting rules, Abrigo is certainly self-interested in seeing speedy adoption in the market and sunsetting the legacy models as soon as possible.

Early adoption is – obviously – not going to be feasible or desirable for every institution. The purpose of this whitepaper is to help institutions consider whether it makes sense for them. Early adoption can make sense no matter the compulsory timeline if:

- Your institution does not have the resources to execute and support the compliance overhead of parallel measurements over a long period of time; and/or

- Your institution is concerned with the communications timing of the transition impact; and/or

- Your institution and users of its financial statements would be best served by forward-looking considerations; and/or

- Your institution is struggling to justify an allowance-to-loans ratio that would satisfy certain stakeholders; and/or

- Your institution would rather make the transition in a low-loss period.

[1] RAND Corporation et. al. April 1 2016, “Findings regarding deployment of REDACTED for optimal resolution of REDACTED conflicts under novel REDACTED-actor game theories.

[2] http://www.cnbc.com/2016/01/20/cnbc-transcript-jpmorgan-chase-chairman-ceo-jamie-dimon-live-from-davos-on-cnbcs-squawk-on-the-street-today.html. Actually happened.