The Financial Accounting Standards Board’s (FASB) Accounting Standards Update (ASU) 326 provides the guidance for estimating allowances for credit losses, as the current expected credit losses methodology (CECL) will be applied. The allowance will be reported as a valuation account, or the difference between the financial assets’ amortized cost basis and the net amount expected to be collected.

Two common questions that bankers ask about FASB’s CECL model are:

1) What methodologies make the most sense for CECL?

2) What are the data requirements for my institution?

The guidance is not prescriptive in nature, which allows for flexibility in an institution’s approach. While this leaves room for ambiguity around the execution of the calculations and compliance with the new standard, it also provides institutions the opportunity to assess their assets and associated data and create a plan that they can defend based on their own analyses and methodologies chosen.

Answer: What methodologies make the most sense for CECL?

The new accounting standard does not specify a single method for measuring expected credit losses. Institutions should use their best judgment to develop estimation methods that are well documented, applied consistently over time and faithfully estimate the collectability of financial assets by applying the principles in the new accounting standard.

Before matching method with loan pools, institutions should make sure that their pools are adequately segmented and that the data being assessed is valid. Segments or pools should have similar risk characteristics and should be as granular as possible while maintaining statistical significance. Management will need to evaluate pools on an ongoing basis to ensure that the underlying assets continue to exhibit similar risk behavior.

Methodologies that will be available to most institutions include vintage analysis, historical loss to migration analysis, probability of default/loss given default and discounted cashflow. To learn more about available methods access the on-demand webinar series here.

Answer: What are the data requirements for my institution?

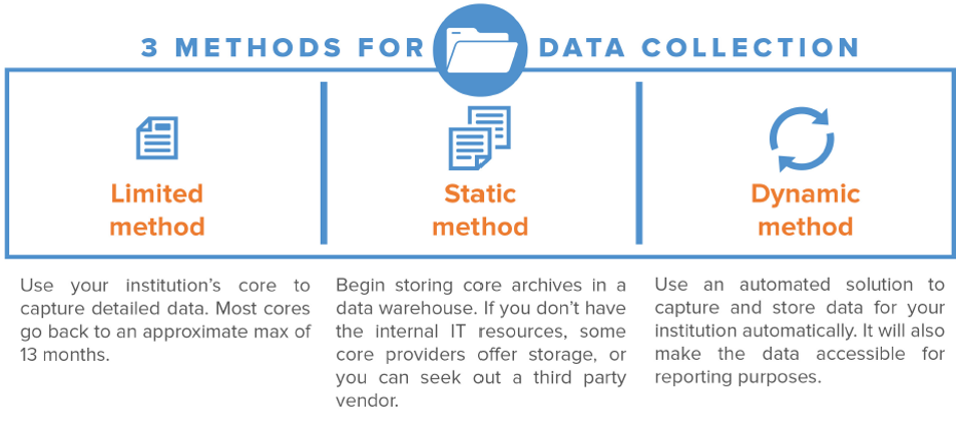

For institutions that wish to have flexibility in methodologies, it is important to have the proper loan-level data in order to run more robust and forward-looking calculations. Capturing this data is a prerequisite for testing methodology changes and planning for potential capital adjustments.

Entities are required to estimate expected credit losses over the contractual term of the financial asset(s). Prepayments will need to be considered as a separate input or embedded in the credit loss experience. Expected life is a critical component of all methodologies used to determine loss experience. Prepayment and/or mortality rates will provide for increased flexibility and defensibility.

When developing an estimate of expected credit losses on financial asset(s), entities are required to consider available information relevant to assessing the collectability of cash flows. Also, entities need to consider relevant qualitative and quantitative factors that relate to the environment in which the entity operates. Understanding and documenting how each segment or pool reacts using various methodologies will yield more accurate reserve levels and provide management, auditors, and regulators with confidence that proper due diligence was performed. Additionally, quantifying loss experience throughout economic cycles is a component of the calculation that requires an iterative process over multiple periods.

For a tentative list of data elements to consider for expected loss calculations, download the CECL Field Guide written by Abrigo.