An upcoming whitepaper and webinar by Garver Moore, Managing Director of Abrigo Advisory Services, will explore differences between the CECL and DFAST exercises; this blog post excerpts a discussion on CECL within DFAST.

Allowance and provision projections in stress tests typically are handled in one of two ways:

First, for entities with top-down, backward-looking Allowance models, the notional Allowance is computed for each stress period based on prior period simulated results. Alternatively, some entities model the relationship between the economic factors, loss rates, etc. and historical Allowance levels, and use this to set Allowance levels (and thereby provision amounts) in their modeling. Both of these approaches are conceptually sound, but raise two important questions, one of which was mercifully answered this month.

How should my DFAST models account for the accounting change on my adoption date?

It is conceptually unsatisfying to have to model a cumulative-effect accounting entry in the middle of the stress period that may potentially move capital into the Allowance for Credit Losses. The presentation matters alone (ALLL? ACL?) are confounding, and since the Allowance fundamentally impacts the timing of loss presentation in income and not the amount of the loss, pointless for purposes of the safety and soundness exercise. Further, the only way to comply with the requirement would be to complete your CECL implementation effort when the adoption period appeared in DFAST scope – which has already occurred as of this publication.

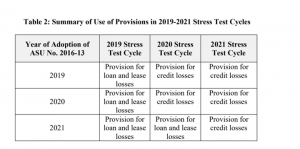

A proposed rule published 17 April, 2018 codifies clear guidance for institutions on this first question – note the rulemaking process is ongoing as of the date of publication of this whitepaper – even early adopters of the CECL standard should wait until the submission year of their required adoption date to include CECL modeling assumptions in their ACL/PCL reporting under DFAST. In other words, submitters should not model the adoption of CECL in their projections.

How do I model CECL when the time comes to do so in my submissions?

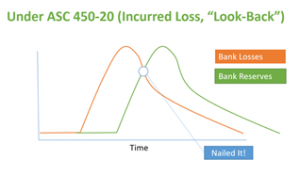

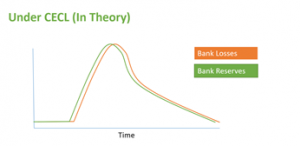

Unfortunately, we do not have an answer to this question. In the 2020 stress cycle, there will be no data available to regress ALLL or ACL levels under the CECL notion to *any* economic indicator, so that approach will not be possible. The notional-allowance approach begs some philosophically profound, ultimately pointless conceptual questions. Under the current practices around the Incurred Loss notion, ALLL levels are set responsively to past events, which makes them easy to calculate but practically guaranteed to be wrong in a dynamic environment. This is one of the fundamental drivers of the change in accounting standard for the Allowance for Credit Losses. In contrast, CECL attempts to project expected losses in its ACL:

This change is not immediately problematic until we consider how a projected institution would perform projections of loss! Do DFAST submitters need to model how their model would model the scenario? Do we assume these simulated bankers have accurate forecasts? Do we assume they’ve implemented the CECL / ACL notion correctly? Are you, the reader, just a tiny computer simulation of a banker in some megaverse preparing its own DFAST submission? Am I, the author? How did we get here? Do we truly remember yesterday, or are we only simulated/programmed to think we remember?

The conceptually soundest approach— and coincidentally, the easiest to implement – is to make the assumption that our DFAST model bank can accurately model its own future credit loss, and has access to correct forecasts, the effect of which would be a large provision event in the first stress period to absorb the losses of the subsequent periods, with bonus points awarded for separating loans-on-book versus new production in the stress period. A two-year stress period would be well within the weighted average loan life for most segments, so the new production component would be the primary difference between CECL ACL estimations and DFAST loss projections within the stress period. Ultimately, the acceptable practices for this problem are not the author’s decision to make, but we advise readers to submit requests for clarification on this matter within the rulemaking process mentioned above – we certainly intend to.

—

Garver Moore

Garver Moore works with the Advisory team at Abrigo, collaborating with our internal product specialists on our market offerings and assisting clients who want to optimize their institutions for growth and profitability. Garver brings a decade of enterprise software, analytic and advisory experience to the team. Before joining Abrigo, Garver served customers as a consultant with Accenture, and he later worked with C-suite executives on technology strategy and delivery as a managing partner of the Orange Advisory Group. He received his bachelor’s degree in computer engineering from Duke University