A Dive Into FASB’s CECL & IASB’s IFRS 9

May 21, 2015

While the International Accounting Standards Board (IASB) issued its standard for accounting for expected credit losses in the form of IFRS 9 Financial Instruments in July 2014, the Financial Accounting Standards Board (FASB) is still in the deliberation phase of issuing its American equivalent, the Current Expected Credit Loss (CECL) model. The standard is expected to surface later this year, per the head of the Institute of Chartered Accountants in England and Wales (ICAEW) and author of the recent article “Moving to more forward-looking loan-loss facilities,” Dr. Nigel Sleigh-Johnson.

He starts by recounting the evolution of the guidance, citing the G20 leaders’ April 2009 meeting in London, calling upon the accounting standard setters to “take action…to reduce the complexity of accounting standards for financial instruments” and to “strengthen accounting recognition of loan-loss provisions by incorporating a broader range of credit information.”

Sleigh-Johnson then fast-forwards to the present day and gives an overview of current affairs: “The IASB has finally crossed the finishing line. Regrettably, the international standard setter did not cross that line together with its US counterpart, the Financial Accounting Standards Board (FASB).” His seemingly weighted “regrettably” is substantiated by his explanation of how a divergence between the standard setters creates a discrepancy in “how and when banks recognize losses relating to their loan and mortgage books.” He does, however, mention that “both boards are, importantly, moving from an ‘incurred loss’ approach to a more forward-looking ‘expected loss’ model.”

He goes on to depict differences in the two approaches, namely, that “The IASB is introducing a three-stage approach, which will see lifetime expected credit losses recognized only where credit risk has increased significantly since initial recognition”…and “On the other hand, the FASB’s standard, due out later this year, recognizes lifetime expected credit losses upfront for all loans.”

He then expresses the viewpoint of the ICAEW, stating the “ICAEW does not support this model as it may lead to banks recognizing accounting losses when they advance new loans which are expected to be profitable, which could have unintended commercial and broader economic consequences,” and “We doubt that recognizing ‘too much, too soon’ is better than recognizing ‘too little, too late’. The difference in approach between the two standard-setters is not ideal either from an investor or reporting entity point of view.”

His comment could be taken as a chauvinistic manifestation of his role of Head of Financial Reporting Faculty for the ICAEW, but nevertheless, there are still many “CECL naysayers” that believe accounting for lifetime expected losses upon origination leads to inflated reserves.

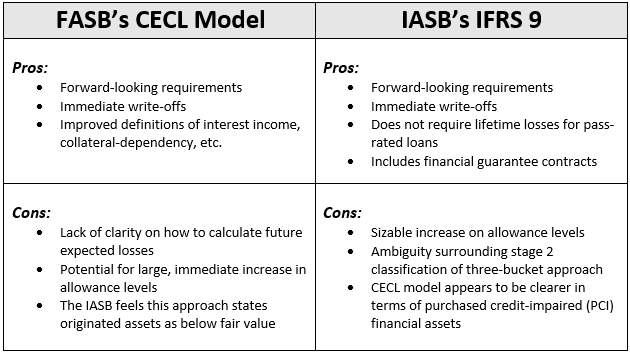

Let’s dive into the pros and cons of each model:

Both of the new regimes seem to quell the origin of the problem in today’s incurred loss model – that losses can only be recognized when they are probable. While CECL will introduce a loan loss provision for performing, low credit risk graded loans, many view this model as a far more objective and rational approach than the IASB’s IFRS 9. Opponents of the IASB’s model claim the three-bucket approach introduces unneeded subjectivity into loan classification and that the structure of the model is vastly more complex than the FASB’s CECL model. Conversely, proponents believe the extra bucket is a needed step to represent the portion of an institutions portfolio that does not exhibit a material level of credit risk, and believe that a year’s worth of expected loss, rather than expected losses over the life of the loan, is a more appropriate method of loan loss provisioning.

Toward the end of his article, Dr. Sleigh-Johnson highlights a few significant points regarding the introduction of the new standards:

- Considerable costs will be involved in meeting the new requirements

- Banks’ provisions are likely to increase as a result of using the new standard

- And this, in turn, will have an impact on banks’ regulatory capital levels

On a positive note, he concludes that “the completion of the project has been widely welcomed and few would disagree that this is a major and long-overdue improvement to financial reporting.”

For more information on the FASB’s CECL model, download Abrigo’ and ALLL.com’s CECL Prep Kit.