How will the FASB’s CECL model impact your ALLL?

Sep 16, 2015

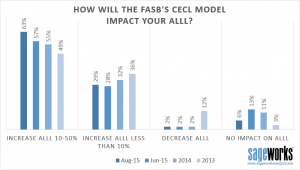

In an August webinar on the do’s and don’ts for CECL preparation with more than 750 banking executives in attendance, Abrigo polled attendees for their thoughts on how the FASB’s current expected credit loss (CECL) model might impact their institution’s (ALLL) reserve allocation. Abrigo has conducted this poll intermittently over the past two years in order to gauge how bankers view the anticipated impact of the impending guidance based on the latest news and knowledge of the CECL model.

As illustrated by the graph, the poll indicates a continued increase in the percentage of bankers who expect the CECL model to increase their ALLL allocation by 10-50 percent — from 57 percent in June to 63 percent in August. This is significant in that it shows a 6 percent increase in bankers expecting a sizable increase in their ALLL allocation in just two months, and a 14 percent increase since the poll was first conducted in 2013. Additionally, the most recent poll found a decrease, from 13 percent to 6 percent, in the number of bankers who expect there to be no impact on their ALLL in the same two month span. Perhaps most telling is that 92 percent of bankers expect their ALLL to have to increase when the guidance is finalized. The poll found nominal changes in the percentage of bankers who expect an increase less than 10%, and the number who expect a decrease in their ALLL remained consistent at 2 percent.

As illustrated by the graph, the poll indicates a continued increase in the percentage of bankers who expect the CECL model to increase their ALLL allocation by 10-50 percent — from 57 percent in June to 63 percent in August. This is significant in that it shows a 6 percent increase in bankers expecting a sizable increase in their ALLL allocation in just two months, and a 14 percent increase since the poll was first conducted in 2013. Additionally, the most recent poll found a decrease, from 13 percent to 6 percent, in the number of bankers who expect there to be no impact on their ALLL in the same two month span. Perhaps most telling is that 92 percent of bankers expect their ALLL to have to increase when the guidance is finalized. The poll found nominal changes in the percentage of bankers who expect an increase less than 10%, and the number who expect a decrease in their ALLL remained consistent at 2 percent.

As the expected release of the FASB’s CECL model approaches, informal polls like this indicate that bankers are increasingly recognizing that the guidance will most likely carry with it a substantial impact on their allocated reserve, assuming no major changes to the FASB’s proposal occur in the final release. One of the key reasons why the change in guidance remains a controversial topic across the industry is that if an institution’s ALLL does need to rise as a result of the CECL model, it will not be a provisional expense, but rather a one-time adjustment directly from capital. Many in the industry see this as worrisome for banks and credit unions.

While there is no announced date for the final guidance to drop, it is anticipated in Q1 of 2016.