One in six institutions needs ALLL help: Is yours one of them?

Jul 30, 2015

The health of individual financial institutions has been under a microscope since the financial crisis in 2008. While the biggest players in banking earn a national spotlight each spring with stress testing for soundness, all other banks and credit unions also receive attention annually, though less public. All 10,000+ financial institutions in the U.S. are required to undergo an examination process every 12-18 months. A bank or credit union’s exam experience can vary by regulatory agency, region, time period and the particular examiners involved, among other factors. The entire process can be time-consuming, and many bankers and credit unions professionals spend months preparing.

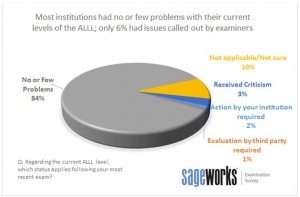

A financial institution’s ALLL calculation is often one of the key pieces examined critically by regulators, particularly after a significant change is made to the loan loss reserve methodology. According to the 2015 Abrigo Bank & Credit Union Examination survey, roughly 1 of every 6 institutions polled was criticized by examiners for the ALLL calculation process, including banks or credit unions that were required to take action as a result of the review. Respondents across all regulatory agencies noted that most criticism on their ALLL stemmed from documentation of the calculation, loss emergence periods and enhancing justifications for qualitative factors.

“A well-documented ALLL policy is the key to ensure compliance with the Guidance,” advised one bank that offered a look at their most recent exam experience.

“A well-documented ALLL policy is the key to ensure compliance with the Guidance,” advised one bank that offered a look at their most recent exam experience.

According to the survey findings, ALLL levels for individual institutions were well-received by examiners. Only six percent of those polled indicated that their examiner required them to take action, and many pointed to Q factors as the trouble spot. One NCUA-regulated credit union offered this advice for their peers: “Use good analysis and document reasons for applying any qualitative factors.” Another OCC-regulated bank added, “Make sure your qualitative factors are consistent on a quarterly basis, and be sure that the rationale for any changes is clear and documented.”

Documentation was also mentioned across all agencies as paramount. More is more. Examiners expect documentation of the entire ALLL methodology to be clear, too. One FDIC-regulated institution said plainly: “Document the policy, document the methodology, document the process, document the procedures, document the documents.”

Estimating the ALLL is no doubt a complex process, and few, if any, institutions have the exact same process for the calculation. Given that, examiners understandably want to know that a bank or credit union is able to remain consistent in their process and document the assumptions that impact the final figure in the reserve.

Related Asset - Whitepaper:

Complete Guide to the ALLL eBook

Complete Guide to the ALLL eBook - Download the PDF