Written By: Jeff Judy

Working backwards from the difficulties some banks have faced in recent years, we can see that many of them were not prepared to deal with an economic downturn that sharply curtailed both their debtors’ ability to repay and their opportunities for booking new business. They did not set aside the reserves they needed to cope with the problems that arrived with the recession.

Now, at some institutions, the giddy pursuit of easy money, and the relaxing of basic prudence in managing their portfolios, was the root cause of their troubles. But there were also many banks that probably would have been in better shape if they had a more systematic approach to predicting where the credit they extended to their borrowers was headed. They embraced the principle of setting something aside for that inevitable rainy day, but they were just guessing at how big a rainy day fund was needed!

And, with the euphoria of the period just before the recession, it was probably a little easier to guess wrong, to find yourself with an ALLL allotment that wasn’t nearly enough to bring you smoothly through very tough times and dramatically different business conditions. But without data collection, analysis, and a commitment to being guided by that analysis, all you can do is guess.

That’s why we talk about “migration analysis,” or, as I like to think about it, “terminal risk analysis”: identifying the patterns your portfolio exhibits in terms of changing risk profiles over time. At its simplest, this sort of analysis is highly actuarial. It just reveals what portion of any given risk category will, statistically, move into another risk category.

Even that level of analysis is a big improvement over an educated (or not so educated) guess. And even that level of analysis requires some planning, diligence, systematic data management, and regular review.

In fact, you need the same basic systems and processes no matter how simple, or how sophisticated, an analysis you hope to achieve. If you want to base reserve allocations on a more objective prediction of your portfolio’s future, you must make a commitment to:

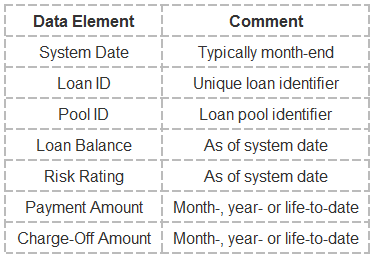

- A well thought out data gathering plan. Below are the minimums needed to use any sophisticated ALLL methodology. Many more — such as organizational identifiers, past due/ impairment status, and attributes at loan origination — would be useful for selecting subsets of loans to do more refined analyses. Preserving payment data is often difficult for community banks, because the life of transaction data can be fleeting.

With some ALLL methodologies, as little as four months of data is enough to do raw calculations and thirteen months enough to show something meaningful … but five or more years are needed to fully develop trends and comparisons with economic conditions.

- A consistent, objective risk rating system. The more you leave risk rating to banker judgment, or the more reluctant you are to downgrade credits in a timely fashion, the less accurate your migration predictions are going to be.

- Analytical tools. How sophisticated your tools are, often involving specialized software, depends on your resources, your goals, and how finely you want to be able to slice and dice the data.

- Action-oriented portfolio review. If you are not going to take action based on the results — adjust guidance to bankers, tweak ALLL, etc. — do not bother doing the analysis!

The details of your own terminal risk or migration analysis may be quite different from the bank down the road. You may collect different data, have a different risk rating system, have fancier or simpler software tools, and so on. They may want a simple statistical prediction to drive their reserves, you may want detailed tracking by location, loan officer, type of business, and more.

But the fundamental conditions needed to reserve wisely are the same. Be consistent in your risk ratings, diligent and thorough in your data collection, and responsive to the results of your analysis. Commit to using data to make better decisions, rather than to rationalize guesses, and you will find yourself better prepared to cope with the ugly surprises that come to all of us in this business.