The deadline for 2023 filers to transition to the current expected credit loss (CECL) model is rapidly approaching. Since the release of the CECL standard from the Financial Accounting Standards Board (FASB) in 2016, financial institutions have navigated changing timelines, opacity in requirements and methodologies available to them, and challenges with building defensible forecasts. Those preparing for the 2023 deadline are no different. Most institutions with a 2023 filing date have started their transition to the new model, but not everyone has begun the journey.

The deadline for 2023 filers to transition to the current expected credit loss (CECL) model is rapidly approaching. Since the release of the CECL standard from the Financial Accounting Standards Board (FASB) in 2016, financial institutions have navigated changing timelines, opacity in requirements and methodologies available to them, and challenges with building defensible forecasts. Those preparing for the 2023 deadline are no different. Most institutions with a 2023 filing date have started their transition to the new model, but not everyone has begun the journey.

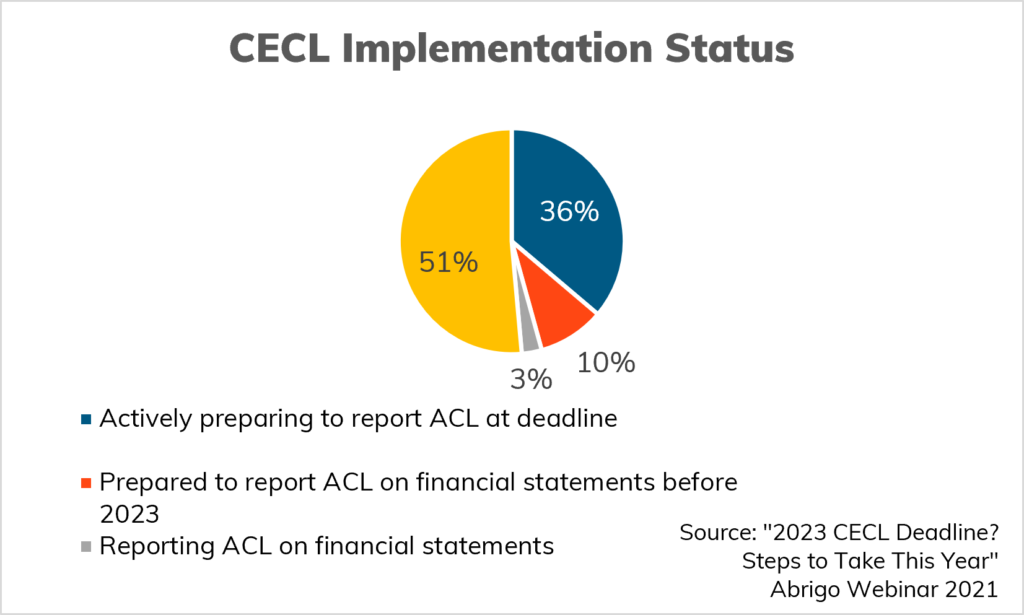

In a recent CECL webinar hosted by Abrigo, which included more than 125 bankers, nearly 40% of attendees indicated they have already started the process of transitioning to CECL and will be ready to report their allowance for credit losses (ACL) according to the expected loss deadlines set by FASB.

However, almost half of respondents stated they are just getting started and gathering information to being the transition. The remaining 13% are either already reporting their ACL on financial statements or will be ahead of the 2023 deadline.

For those institutions that are just getting started or gathering information, time is of the essence. As Brandon Quinones, Director of Client Education at Abrigo, said in a blog post on CECL timelines, “If you’ve kind of been dragging your feet on this, now is the time. The bottom line is, there are no benefits to starting early because it is no longer early. The time is now to ensure you are ready for January 1, 2023.” To be prepared for the 2023 deadline, institutions should consider their modeling options, draft a policy, and start trial and error with their process this year.

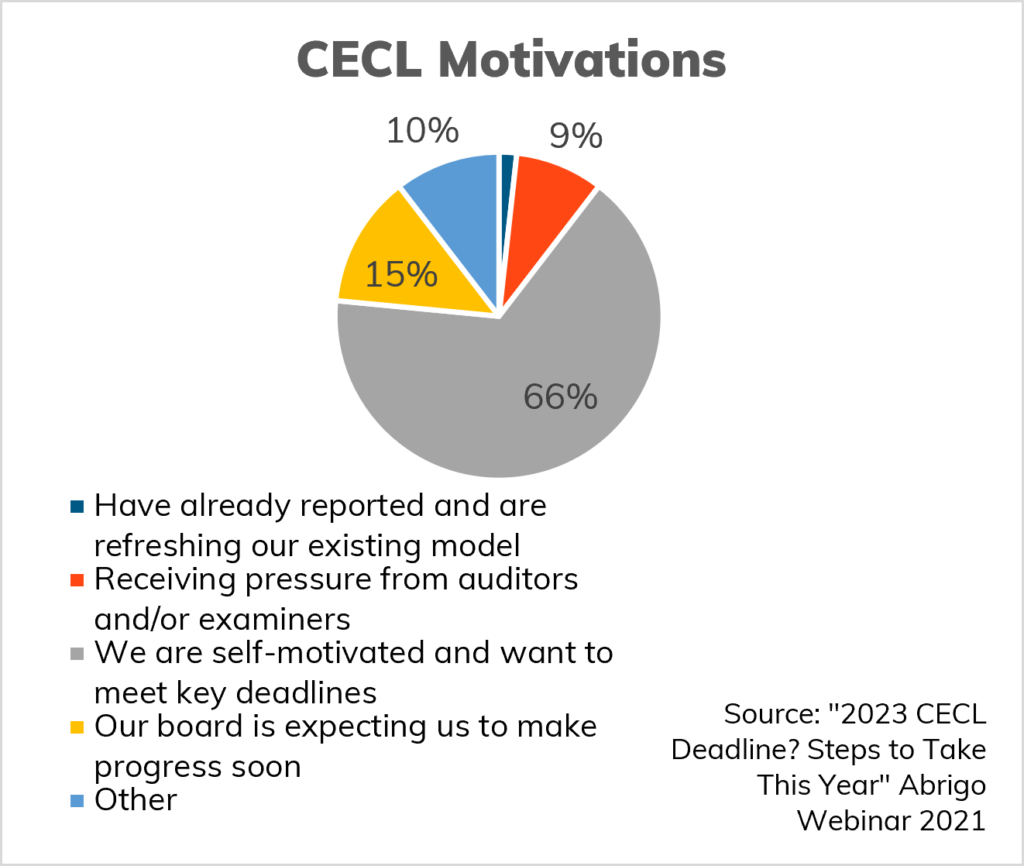

CECL Motivations

What is the motivation for those banks and credit unions who have already started the transition to CECL? A majority, 78%, of our webinar attendees indicated they were self-motivated because of their own ambitions to meet the filing deadlines. Fifteen percent of attendees were under pressure from their Boards to start reporting CECL progress, and 10% indicated examiners or regulators had applied pressure regarding expected losses.

“This rings true with the conversations we are currently having with community financial institutions today,” said Abrigo President Jay Blandford. “This tranche of CECL filers will, in some ways, benefit from some lessons learned by early adopters and SEC filers, but the CECL model is still a significant change to their internal processes and data. CFI leaders don’t want to wait until it’s too late, which is why we see more institutions jumping in,” he added.

The biggest takeaway for institutions who are at the “standing start” or “gathering information” phase is that it is not too late to start, but they need to start soon. “Where to begin is difficult, especially if we are looking at a blank spreadsheet,” commented Abrigo Advisory Manager Jared Mills during the webinar. Some of the biggest CECL “unknowns” stem from documentation requirements, methodologies, and forecasting. Community financial institutions that are just getting started with their transition to CECL should consider a partnership with a third-party vendor and begin assessing data gaps and accuracy.

For those institutions looking to self-start, Abrigo’s CECL Prep Kit is a good place to start as it contains links to the standard as well as resources for understanding the data requirements, implementation timelines, and best practices.

No matter what motivates an institution to start the transition to CECL, the key to a successful implementation is to get started as soon as possible. The sooner an institution starts, the more time it has to consider the available options, develop and implement processes, test various models, and successfully complete the transition to CECL.

Still have questions? Consider partnering with a vendor who has CECL transitions across hundreds of banks and credit unions.

For financial institution leaders still wary of ACL reporting, ALLL.com includes resources to answer common questions and outline how to get started with data.