Preparing for CECL data requirements

Mar 9, 2016

The Financial Accounting Standards Board (FASB) is expected to release the final standard of the current expected credit loss (CECL) model in the first half of 2016.

The Financial Accounting Standards Board (FASB) is expected to release the final standard of the current expected credit loss (CECL) model in the first half of 2016.

The CECL model is a change in guidance for the allowance for loan and lease losses (ALLL) that will include, among other provisions, forward-looking requirements, a longer loss horizon and removal of the “probable loss” threshold. While there are still a number of questions and concerns from some in the banking industry about the proposed model and the impact of implementation, some industry professionals are seeing this as an opportunity to refine and improve ALLL processes and methodologies to more accurately account for risk with an eye toward the future.

For bankers looking to make the most of the accounting change, the need for accessible, loan-level data is recognized as a key step prior to scenario building with more robust methodologies. The CECL guidance is intentionally not prescriptive, which will allow institutions to use models that work best for their unique portfolio makeup. While there will likely be a range of methodologies used for CECL implementation and some may be better suited than others for certain institution sizes and portfolio types, many in the industry are looking at three methods in particular: migration analysis, vintage analysis and probability of default/loss given default (PD/LGD). These three methodologies range in complexity, and each requires unique data points.

Don’t handcuff your institution by not having the proper data.

The importance of having adequate data lies in the fact that CECL will require many institutions to adopt new methodologies, or at least make changes to their current methodology. In order to decide what changes are best, most institutions will run scenarios parallel to the institution’s current ALLL to see what is most accurate and what the potential impact may be for each method. Put simply, if an institution does not have the right data in an accessible format, scenarios and parallels can’t be performed. If an institution has adequate data, they will have the flexibility to test multiple methodologies before CECL implementation, allowing for a more strategic decision about how they plan to calculate the reserve under CECL.

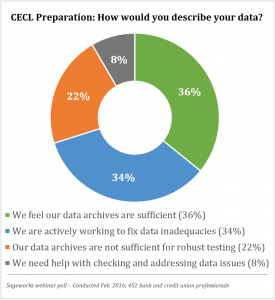

In a recent webinar hosted by Abrigo and CliftonLarsonAllen, The CECL Workshop Series Part II, only 36 percent of 452 respondents indicated that they feel their data archives are sufficient for running scenarios for CECL. Also telling is that 34 percent of respondents are actively working to fix data inadequacies, 22 percent don’t feel their data archives are sufficient and 8 percent need help checking and addressing data issues. This indicates that 64 percent of the polled bankers are not yet ready for modeling scenarios for CECL.

In a recent webinar hosted by Abrigo and CliftonLarsonAllen, The CECL Workshop Series Part II, only 36 percent of 452 respondents indicated that they feel their data archives are sufficient for running scenarios for CECL. Also telling is that 34 percent of respondents are actively working to fix data inadequacies, 22 percent don’t feel their data archives are sufficient and 8 percent need help checking and addressing data issues. This indicates that 64 percent of the polled bankers are not yet ready for modeling scenarios for CECL.

If an institution aligns with this 64 percent, they could find themselves playing catchup to capture the proper data once guidance is finalized – giving them less time for scenarios and parallels before the required implementation date.

How can an institution check for data adequacy?

Institutions should understand the data points required to run certain types of calculations. By making a shortlist of data needed for certain calculations, an institution can check and see if they are missing any key data points. For an overview of data points needed for several methodologies, including migration analysis, vintage analysis and PD/LGD, download the CECL Data Prep Guide.

If an institution finds that their data is inadequate for CECL implementation planning with more robust methodologies, there are several ways to address the issue. An institution may contact their core provider and inquire about data archiving. If the institution’s core provider doesn’t offer a solution, the institution can work with their internal IT department to create an in-house solution or partner with a third-party, trusted vendor.

6 Key characteristics of financial institution data to consider.

On top of archiving the right data, an institution also has to consider the quality of the information. Here are six, key considerations when evaluating institution data quality.

- Transparency. It is important to understand how and where an institution’s data is stored. Having a clear process will help minimize confusion when data is needed to perform analysis or calculations. If a third-party vendor is used, ensure accountability.

- Granularity. CECL will likely require more data, depending on the changes to an institution’s process and calculations. Ensure the database can handle the increased volume as well as the ability to account for the full life of loans.

- Accessibility. Ensure data is readily available in usable formats. Storing info across disparate systems or in unusable formats (.pdf files) can cause efficiency challenges in the future.

- Holistic data. Ensure that data is stored for the whole portfolio and not just for losses.

- Frequency. Data should be updated frequently to accommodate institution needs (i.e., process daily, archive monthly).

- Security. An institution’s database should be secure. If integrated with other solutions, it is important to ensure that data transferred between a core system and a vendor is secure. Data should be backed up frequently and have redundancy to minimize risk.

Related Asset - Whitepaper:

CECL Implementation Prep Guide

CECL Implementation Prep Guide - Download the PDF

Related Asset - Whitepaper:

CECL Data Prep Guide

CECL Data Prep Guide - Download the PDF

Related Asset - Webinar:

Webinar: CECL workshop series – Part II