Regression analysis for CECL calculations

Nov 3, 2016

Regression analysis is a simple tool with direct applicability to the new current expected credit loss (CECL) model’s requirement to apply “reasonable and supportable” forecasts to reserve levels.

Regression analysis allows for setting qualitative adjustment policies that provide a firmer basis for allocations, a measured zone for defensibility in the application of an institution’s judgment and a method for quantifying purely qualitative changes in an institution’s history.

At a high level, what such analysis seeks to describe is the impact of a unit change on one variable (for example, regional unemployment) on another variable (for example, portfolio loss rates), with all else being equal. This “all else being equal” approach simplifies, rather than complicates, the measurement and allows the investigator to focus on the impact of individual changes in the environment. These variables can be continuous, such as Housing Price Index (HPI), Consumer Price Index (CPI), or Unemployment numbers, or they can be categorical. In this way we can answer questions such as, “Adjusting for regional macroeconomic indicators, what is the impact to our loss experience over 12 months of purchasing a portfolio?”

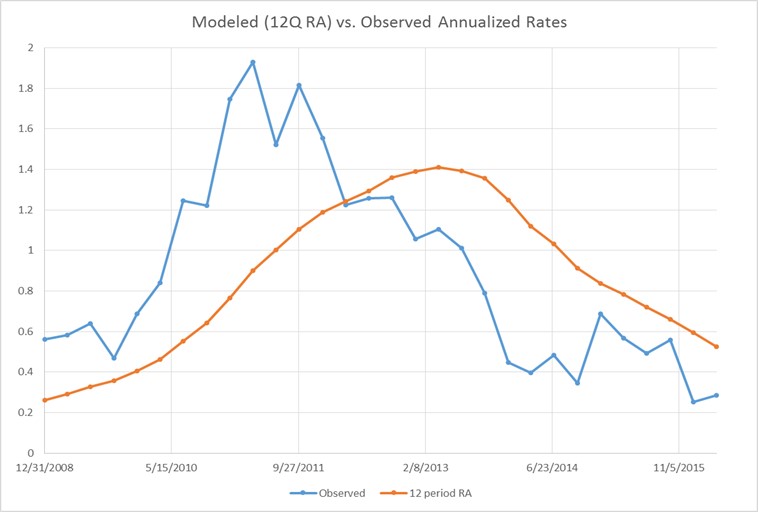

A common methodology used by institutions to calculate a historical loss component is a three-year lookback period with mean, annualized loss rates applied on a segmented or sub-segmented basis. An underlying problem with this methodology is that it will only accurately predict loss experience once in a time of change. Accurate prediction by this methodology requires three years of a relatively stable loss environment.

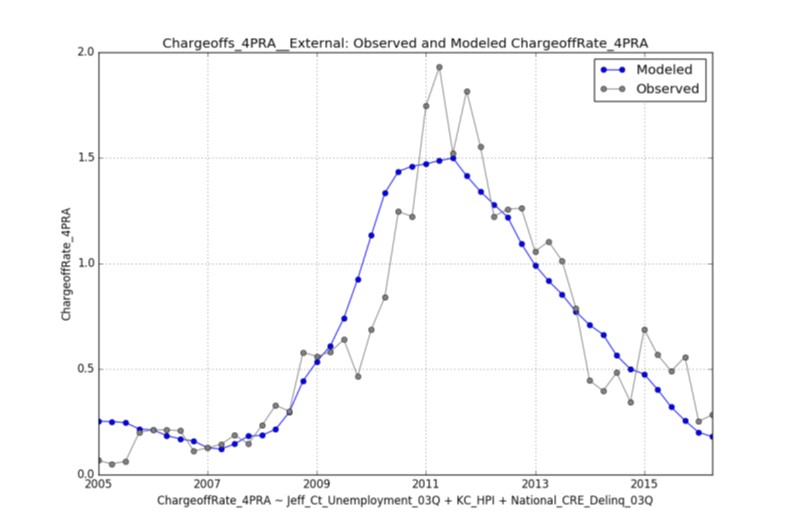

The exercise then requires an institution to make adjustments to try and align the model line (orange, above) to the observed line (blue, above). By way of contrast, for the same institution, a loss model based on underlying drivers of loss achieves much better alignment between conditions and loss description.

A driver-of-loss methodology, then, asks us to adjust the historical experience based on such a descriptive model; in the above example, the adjustments would be based on the International, National, Regional and Local Conditions qualitative factors enumerated in the 2006 Interagency Policy Statement on the allowance.

We can see immediately how a loss estimation approach based on the regression example is more useful to portfolio risk managers, safety and soundness stakeholders, and users of financial statements. The regression analysis generates an allowance immediately responsive to changes in underlying conditions that privilege the drivers of loss today over the coincidental observed loss experience yesterday. The translation to future CECL guidance is an application of the forecasted values of the relevant indicators.

This regression model provides a set of “rails” for an institution to sets its policies and either conservative or aggressive interpretations. This leads to an allowance that fluctuates predictably according to well-documented and well-understood events outside management’s direct control.