FASB member: CECL benefits investors

May 6, 2015

In the Financial Accounting Standards Board’s 6th issue of its e-newsletter, FASB Outlook, Hal Schroeder, member of the FASB, brings to light benefits the new Current Expected Credit Loss (CECL) model provides to investors.

Schroeder mentions that the new model may provide a more accurate reflection of credit losses inherent within banks’ portfolios. He cites that the transition to a CECL model would lead to more timely recognition of credit losses by the following:

- “Recording an allowance that represents management’s estimate of all contractual cash flows not expected to be collected; otherwise known as the Current Expected Credit Loss (or CECL) model. That estimate would use more forward-looking information and avoid the inherent bias of the solely “rearview mirror” approach embedded in current GAAP.”

- “Providing investors with management’s best estimate of expected losses at the point when credits are originated, then updating those estimates as more information becomes available.”

- “Improving disclosures so changes in credit risk would be more transparent. Such disclosures provide investors with information needed to better understand management estimates and, when an investor’s views may differ, to develop their own alternative estimates.”

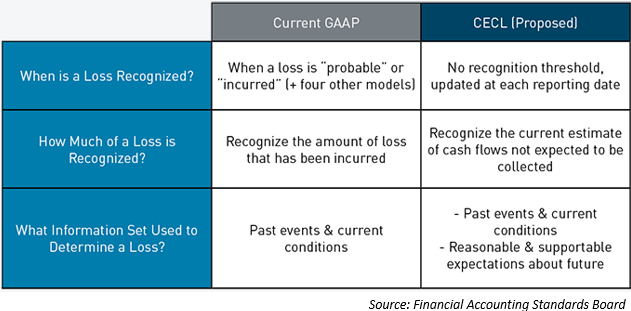

Schroeder goes on to depict three significant differences between today’s incurred loss model and the proposed CECL model:

By transitioning to an expected loss model, investors will be given a more transparent view of credit risk and will be able to derive more information about their investments than they can currently under the incurred loss model. Schroeder provides three examples of estimates investors will be able to make upon GAAP’s transition to expected loss:

- “The amount of originations for each period, by class of loans”

- “The original Day-One estimate of expected credit loss (aka provision), as well as subsequent changes to the original estimate”

- “A split of the current-period provision between the portion related to current-period originations and that related to estimate changes for loans originated in prior periods.”

Schroeder concludes his article by restating that the CECL model will reward diligent investors by providing more insight into management’s assessment of credit risk and how that risk changes over time. In his last sentence, he foreshadows the FASB’s timeline on the new standard. Schroeder offers, “Your feedback will help us finalize the standard by the second half of this year.”

Hal Schroeder’s article can be accessed here: For the Investor: Benefits of the “CECL” Model and “Vintage” Disclosures.