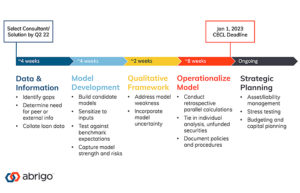

FASB CECL Model: Implementation Plan

CECL implementation will be unique for each institution. It is recommended that institutions form an implementation committee to evaluate the scope of implementing CECL, to understand the costs associated with transitioning, and to create a project plan and implementation timeline.

The effective dates for CECL are as follows:

- For public business entities that meet the definition of an SEC filer, the forthcoming standard will be effective for fiscal years (and interim periods within those fiscal years) beginning after December 15, 2019.

- For other public business entities, the forthcoming standard will be effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years.

- For all other entities, including not-for-profit organizations and employee benefit plans, the forthcoming standard will be effective for fiscal years beginning after December 15, 2021.

- Early adoption will be permitted for all entities for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years.

Related Asset - Blog

Final CECL guidance issued by FASB

Excerpt Pulled From Blog:

"The Financial Accounting Standards Board (FASB) has issued its final guidance on the new current expected credit loss (CECL) model. Here are the details."

Read More: https://www.alll.com/resource-center/final-cecl-guidance-issued-fasb/

Related Asset - Whitepaper:

CECL Implementation Prep Guide

CECL Implementation Prep Guide - Download the PDF