Final CECL guidance issued by FASB

Jun 16, 2016

The Financial Accounting Standards Board (FASB) on Thursday issued its final guidance on the new current expected credit loss (CECL) model, saying the new standard will improve financial reporting by requiring timelier recording of credit losses on loans and other financial instruments.

In a news release, the FASB outlined the Accounting Standard Update (ASU), which:

- Requires financial institutions to measure all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts that incorporate forward-looking information.

- Requires enhanced disclosures on the significant estimates and judgments used to estimate credit losses, as well as on the credit quality and underwriting standards of an organization’s portfolio. These disclosures include qualitative and quantitative requirements that provide additional information about the amounts recorded in the financial statements.

- Amends the accounting for credit losses on available-for-sale debt securities and purchased financial assets with credit deterioration.

“The new guidance aligns the accounting with the economics of lending by requiring banks and other lending institutions to immediately record the full amount of credit losses that are expected in their loan portfolios, providing investors with better information about those losses on a more timely basis,” FASB Chair Russell G. Golden said in the release.

The final standard is available here: Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments

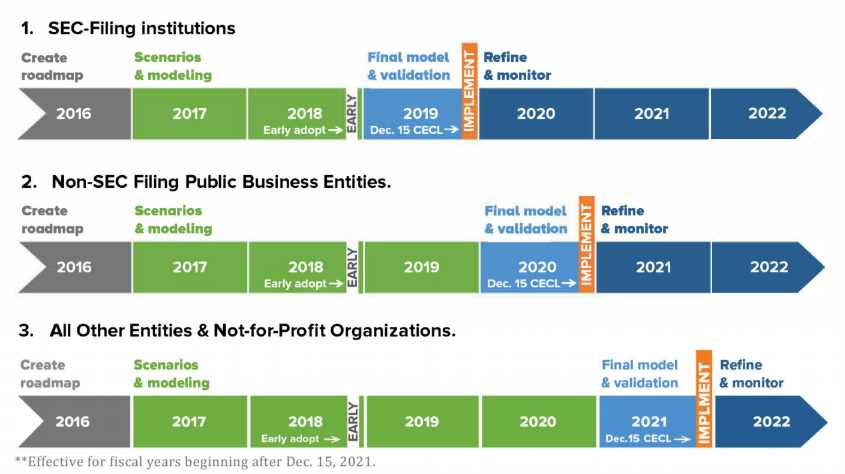

Abrigo has numerous resources to help bankers understand and begin preparing for implementation. SEC filers must begin using the new standard for fiscal year and interim periods that begin after Dec. 15, 2019. It is effective for non-public banks and credit unions for fiscal years starting after Dec. 15, 2021. Early adoption is permitted for everyone after Dec. 15, 2018.

Among the resources available:

CECL Methodology Series Webinar – Abrigo hosted a webinar series that, across multiple sessions, breaks down the standard and shows examples of how to implement it across loan pool types, include CECL calculations in C&I, CRE, Consumer and other asset classes.

CECL Prep Kit – Access key resources with this complimentary toolkit. This kit includes key links to FASB and industry resources, as well as on-demand webinars and handy prep guides.

CECL Data Prep Guide – Provides a summary of data requirements under CECL and outlines some objectives and challenges for your institution to consider while identifying, assessing and addressing your data needs.