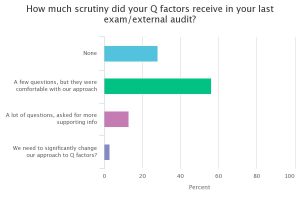

At this point in the in the transition from FASB’s incurred loss to current expected credit loss model (CECL), financial institutions are starting to recognize the importance of creating a practical plan to navigate the accounting change. During a recent webinar, Abrigo Senior Consultant Tim McPeak and Danny Sharman, an implementation consultant, shared tips to help institutions get started. During the presentation, they also discussed current practices regarding the use of qualitative factors, or Q factors, in the allowance and how to prepare for using Q factors under CECL. A poll of 254 webinar attendees showed that Q factors are a common area of questioning by auditors and examiners.

Q Factors

Over 56 percent of respondents had some scrutiny around Q factors during their last external audit or exam, including 13 percent of respondents who were heavily scrutinized and were asked to provide more supporting information. Only about 1 in 4 respondents said their Q factors received no questions during the exam or external audit. This data shows that the majority of financial institutions do have to answer questions about their Q factors during exams and audits.

Reflecting on the results, McPeak said, “No promises here, but that level of scrutiny today is a good way to think of what bar financial institutions are going to need to clear from a forecasting standpoint. They’re not the same, but they are pretty related in a subjective nature”.

McPeak also said that “the reality is that the market is heavily dependent on the subjective side and auditors dislike that. It is really hard to audit a bank when the vast majority of the reserve is based on qualitative adjustments”. Abrigo looked at its client base in the summer of 2017 and discovered that for every dollar of reserve, roughly 70 to 75 percent of it was qualitative. Both speakers agreed that because of this, it is likely that Q factors will still be prevalent under CECL. However, over time, the goal is most likely to be less reliant on them.

Sharman expanded on this thought. “Even if the qualitative factors are a large component of the reserve calculation, making qualitative factors more quantitative by using industry data will be a common piece of feedback from auditors towards the approach of CECL,” he said.

To learn more about preparing for CECL, listen to the on-demand replay of the webinar, “CECL for Community Banks: The Practical Path.”