A majority of bankers expect their financial institutions to use third-party vendors or a combination of advisors and third-party vendors to help them implement the current expected credit loss model, or CECL, according to an informal poll released by Abrigo and MST.

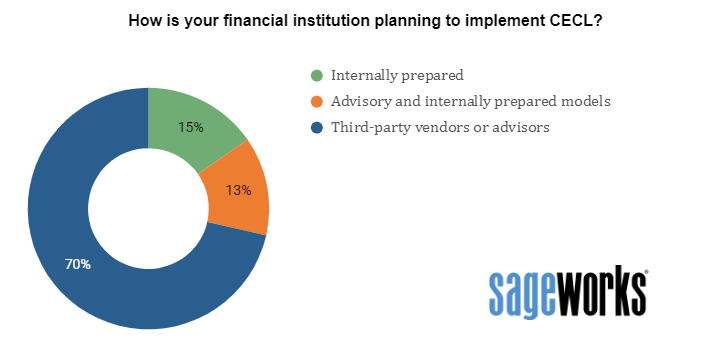

During a CECL panel webinar hosted by the firms, 315 bankers were asked how their institutions plan to implement CECL, the Financial Accounting Standards Board’s new requirements for accounting for credit losses. Thirty-seven percent of those polled said they plan to use models developed through advisory services and third-party vendors/products, and 33 percent said they plan to use an external product alone. In other words, more than two-thirds of those polled will rely on external models rather than internally prepared models.

Only 15 percent plan to rely solely on their own resources, and another 13 percent will use a combination of in-house and advisory prepared models. None of those polled planned to completely outsource the CECL implementation to an advisory services firm.

Abrigo Managing Director of Advisory Services Neekis Hammond said the poll’s results are consistent with what the Abrigo Advisory Group team is seeing in their work, particularly among SEC registrants. “A lot of institutions are utilizing third-party solutions, but many of these institutions are also partnering with advisors to help them transition to CECL,” Hammond said. “Advisors can help the institutions prepare for the organizational and operational implications, such as developing an effective data strategy plan, methodology selection, developing ‘reasonable and supportable’ forecasts, and quantifying the impact of various forecasted conditions.”

Banks that file with the Securities and Exchange Commission must comply with CECL in 2020; all other financial institutions have until the following year. The American Bankers Association, which has said CECL represents the biggest accounting change in banking history, has endorsed Sageworks ALLL and MST Loan Loss Analyzer to help financial institutions meet the upcoming deadlines.

Additional Resources

Whitepaper: CECL Software Buyer’s Guide: Vendor due diligence for CECL solutions

On-demand Webinar: CECL Webinar Panel: Answers to Your Top Questions