Loan loss reserve levels continue to drop

Dec 4, 2015

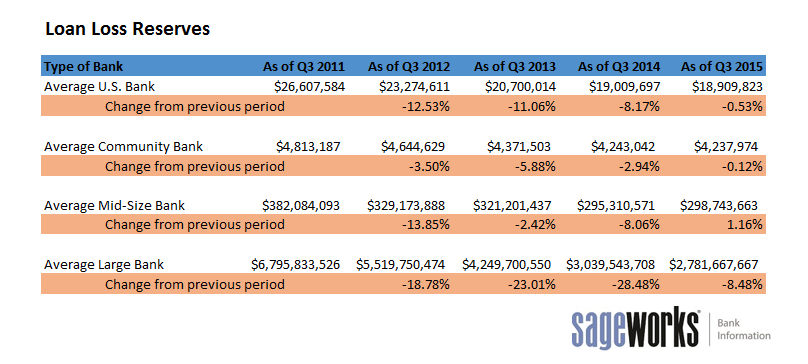

Third-quarter loan loss reserves dipped below levels from a year earlier as U.S. banks, on average, continued to slow the rate at which they reduced pools of money set aside to cover incurred credit losses.

The allowance for loan and lease losses, or ALLL, for the average U.S. bank in the third quarter was $18.9 million, or 0.5 percent below the $19.0 billion average a year earlier, according to data researched through Abrigo Bank Information. That’s a smaller drop than in recent years, but the current average ALLL is 29 percent lower than in the third quarter of 2011.

Tim McPeak, a director in the financial institutions division of Abrigo, said lower ALLL levels could reflect a variety of factors: “The reduction in allowance levels might reflect a confidence in the health of the U.S. economy on the part of U.S. banks,” he said in a data release. “When the economy is in good shape, there are generally less defaults on loan payments.”

This relationship between the economy and credit quality is also reflected in the average net charge offs for U.S. financial institutions, McPeak said. The average U.S. bank had $4.2 million in net charge offs as of the third quarter, or roughly a third of the average charge offs as of the third quarter of 2011.

Lower loss reserves might also reflect the fact that a significant number of financial institutions have closed over the past five years. The metrics in this report are based on FFIEC Call Report data for all 6,331 U.S. banks that were in operation during the third quarter of 2015, and the historical data includes metrics for financial institutions that were no longer in operation at the time of writing. For example, in the third quarter of 2011, there were over 7,400 banks in operation in the United States.

“One of the chief reasons that banks have had to shutter their doors was trouble in the loan portfolio,” said McPeak. “It’s possible that many of these institutions that have since failed were forced to set aside more money to cover loans, given the losses that they had already incurred. You can also see this fact reflected in the difference between then and now in the average ‘net charge offs’ figure.”

While most U.S. banks are seeing reserves decline year-over-year, the largest banks in the country, those with more than $100 billion in assets, are experiencing the biggest reductions. The average large bank’s loan loss reserve in the third quarter was 8.5 percent below the year-earlier level and less than half of the average in 2011.

Mid-sized banks, or those with assets between $10 billion and $100 billion, actually boosted their average ALLL in the third quarter by 1.1 percent to $298.7 million, compared with the same period a year earlier. Mid-sized banks’ average ALLL is 22 percent lower than in the third quarter of 2011.

Community banks, or those with less than $10 billion in assets, lowered loan loss reserves by 0.1 percent, leaving the ALLL on average about 12 percent lower than four years earlier.

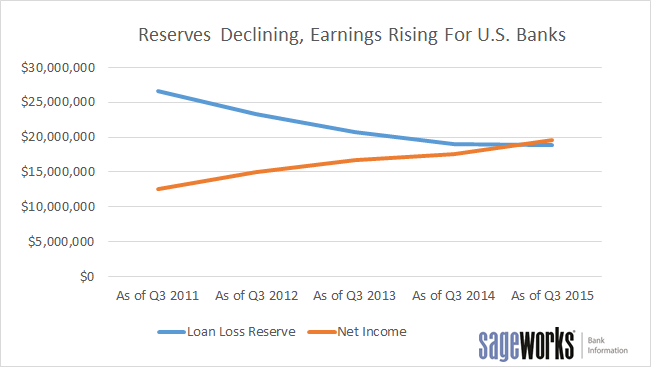

U.S. banks also generated the highest average third-quarter earnings in several years, and they loaned more money to businesses, according to the data researched through Abrigo Bank Info.

The average U.S. bank earned nearly $20 million in net income in 2015 as of the third quarter, compared to about $17.6 million a year ago and $12.5 million as of the third quarter of 2011. “Each bank, on average, is seeing its strongest earnings since the recession so far this year,” said Abrigo analyst James Noe.

McPeak added that it isn’t surprising that reserve levels and earnings have trended in opposite directions. Provisions for the ALLL reduce earnings; conversely, earnings are boosted when ALLL levels are lowered. “If a bank feels comfortable setting aside less for the loss reserve, it would lead to higher net income for that bank,” he said.

Loans to businesses (via commercial and industrial loans, commercial real estate loans and small business loans) continued on a multi-year upward trend during the third quarter. The average bank’s level of outstanding commercial and industrial loans is 66 percent higher than during the third quarter of 2011, while small business lending is about 16 percent higher, on average.