Poll: When Institutions Plan to Start CECL Calculations

Jul 28, 2016

The Financial Accounting Standards Board finalized their accounting standard for calculating current expected losses, and for many institutions, there is a waiting period before the model has to be implemented.

Though those deadlines seem far off, bankers are now recognizing that the change to the allowance for loan and lease losses isn’t an overnight fix. Instead, proactive institutions recognize the advantage in running a “CECL calculation” – or using a methodology that complies with the newly proposed standards – well in advance of the deadlines.

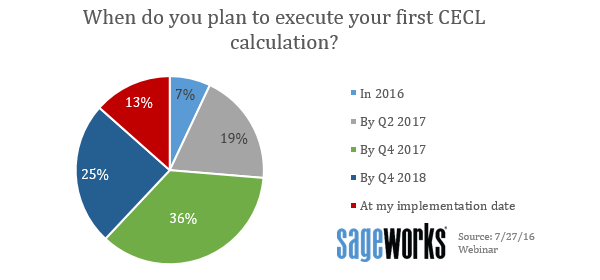

In a July 27th webinar hosted by Abrigo, more than 170 bankers were polled to see when they plan to roll out their first CECL calculation, which would most likely be parallel with their existing incurred loss model. Of the respondents, only 7 percent said that they intend to try a CECL calculation in 2016.

Poll from Abrigo webinar hosted on July 27, 2016. Respondents included bank and credit union executives from institutions of various sizes.

However, when combining the options, 62 percent of respondents said that by the end of 2017 they intend to run a CECL calculation. An additional 25 percent said they would execute a CECL calculation by the end of 2018, and a resolute 13 percent indicated they are waiting on their implementation date as required by the FASB and their regulator.

The benefit to implementing early isn’t just to show a proactive attitude to regulators or auditors. In fact, Neekis Hammond CPA, and Abrigo senior risk management consultant on the webinar, indicated that early implementation is almost necessary for institutions that want to compare different scenarios and have flexibility in the future.

Hammond explains, “In the banks that I talk with, they are looking to get board approval right now in Q3 and Q4 and then begin integrating and running these calculations in 2017.” He continues, “For those that are on the later end of that spectrum by 2018, I think that’s okay if you don’t have a lot of loans with a long life like residential loans or longer CRE loans.”

For institutions that do implement or start running CECL calculations as early as 2017 or even 2016, “They will have the most flexibility when it comes time for implementation, and it’s not just about getting your data right and being able to do the calculation. It’s about having a database of results that you can pull from at any point in time to adjust your calculation. You will come to a point in time – it may not be now or even 2021 – but you’ll be in a different loss environment. You’ll want to have different observations of losses in different loss environments.”

For more on implementation requirements and deadlines, download the Implementation Prep Guide.