Is your institution properly testing for impaired loans?

Aug 25, 2015

There is a widely used practice within the community bank market that is not in accordance with guidance for the allowance for loan and lease losses (ALLL) calculation. Many banks and credit unions test loans for impairment in order to decide whether they belong within the ASC 30-10-35 (FAS 114) category, then move them back within their homogeneous pools under ASC 450-20 (FAS 5) if zero impairment is found. This practice is flawed in that a loan is still considered impaired if it meets the criteria of an impaired loan and should remain under ASC 30-10-10-35, regardless of whether zero impairment is found once evaluated using one of the three valuation methods.

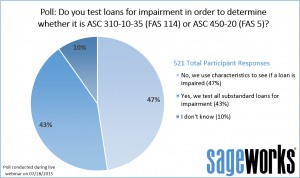

During a recent webinar hosted by Abrigo on the topic, a poll was taken asking the question of whether or not, in their respective institutions, loans are tested for impairment in order to determine whether it should be calculated in accordance with ASC 310-10-35 or ASC 450-20. Of the 521 responses, 43 percent said that they test all substandard loans for impairment, instead of using characteristics to first see if a loan is impaired.

During a recent webinar hosted by Abrigo on the topic, a poll was taken asking the question of whether or not, in their respective institutions, loans are tested for impairment in order to determine whether it should be calculated in accordance with ASC 310-10-35 or ASC 450-20. Of the 521 responses, 43 percent said that they test all substandard loans for impairment, instead of using characteristics to first see if a loan is impaired.

This poll finding highlights the continued and widely held misconception regarding the difference between the terms “impaired” and “impairment” within the ALLL calculation. In an attempt to clarify the confusion that often leads to this common error, the OCC specifically addressed the issue in a 2006 bulletin Q&A. The excerpt is below:

“If an institution assesses an individual loan under FAS 114 and determines that it is impaired, but it measures the amount of impairment as zero, may it include that loan in a group of loans collectively assessed under FAS 5 for estimation of the ALLL?

Answer: No. For a loan that is impaired, no additional loss recognition is appropriate under FAS 5 even if the measurement of impairment under FAS 114 results in no allowance. One example would be when the recorded investment in an impaired loan has been written down to a level where no allowance is required. (EITF Topic D-80, Question 4)” (http://www.occ.gov/news-issuances/bulletins/2006/bulletin-2006-47b.pdf)”

In order to avoid this common mistake, it is important to understand the difference between an impaired loan and calculating an impairment. Institutions must first identify if a loan is impaired by evaluating certain characteristics. Once impaired loans are identified, an impairment analysis should be prepared using one of three accepted valuation methods. If the impairment analysis returns zero impairment, the loan is still considered impaired and should, therefore, remain within the list of ASC 310-10-35 loans. Institutions may, however, want to re-evaluate loans with zero impairment to ensure proper considerations were made for valuation adjustments.