The extent of segmentation recommended for a bank or credit union depends on the size of the institution and the nature, scope and risk of its lending activities (new products, significant changes to underwriting, origination in new markets, etc.). Guidance suggests the loan portfolio should be segmented into homogenous pools based on similar attributes, “stratifying the portfolio into segments that have common risk characteristics or sensitivities.”1

But, be sure that the segmentation reflects the segmentation risk within your institution’s portfolio. Segmentation strategy should be tailored to each institution to address its specific circumstances and needs.

When segmenting the portfolio, a good starting point is the FDIC call code segmentation (commonly called the Federal Call Code). While it provides some direction, the Federal Call Code may not be granular enough for a thorough evaluation of the portfolio. And more importantly, it may not represent your institution’s portfolio adequately if, for example, loans within one Call Code are spread throughout many different geographic regions.

When choosing to use a segmentation other than the Federal Call Code, institutions will typically segment based on loan type, collateral code or other more metrics. But the concern here can be using too broad of classifications – for example, Consumer, Real Estate and Commercial. This level of segmentation is inadequate and often too general to reveal much about that segment’s risk.

The FASB 2010 Accounting Standards Updates instruct institutions to use at least two levels of disaggregation for their pools. A third level, such as Risk Rating or Risk Grade Level is preferred. It is easy to start broad, then sub-segment based upon portfolio composition.

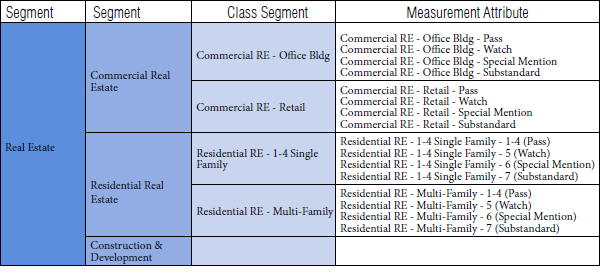

The segmentation sample below shows a potential segmentation strategy, where detail has been show for the CRE or commercial real estate portfolio. It starts with the portfolio segment, then moves to a class level. The third level is the measurement attribute, usually classified by Risk Grade or Risk Rating. With respect to Consumer loans, delinquency ranges can be used (0-29 days past due; 30-59; 60-89; 90+) as the measurement attribute.

1 Qualitative Factors and the Allowance for Loan and Lease Losses in Community Banks; Federal Reserve Bank of Philadelphia. Sharon Wells (examiner) and Trevor Gaskins (Asst examiner); 4th Qtr 2010