Measuring Credit Risk in Consumer Loans under CECL

Feb 14, 2017

A recent poll by Abrigo finds that many financial institutions have work to do when it comes to gathering data to assess credit risk in their consumer loan portfolios under FASB’s new standard for measuring current expected credit losses, known as CECL.

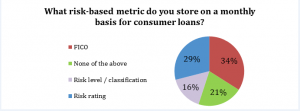

Nearly 1 in 4 of the bank and credit union professionals surveyed during a Abrigo webinar on CECL methodologies said they are not storing on a monthly basis for consumer loans any of the three risk-based metrics Abrigo believes will be good proxies for changes in credit risk over time in the consumer pool. More than 450 participants on the webinar were asked which risk-based metric they store on a monthly basis for consumer loans: FICO scores, risk ratings or risk level/classification. Among respondents:

- 21 percent said they are storing none of the metrics.

- 34 percent said they are storing FICO scores

- 29 percent said they are storing risk rating

- 16 percent said they are storing risk level/classification.

Respondents were asked to select only one choice and therefore, were unable to indicate if they use a combination of metrics.

Banks and credit unions have been evaluating their existing data aggregation policies in preparation for calculating the allowance for loan and lease losses using CECL, which was approved in 2016 and will be adopted as early as 2019 for some institutions. As part of that evaluation, institutions are considering data needs for various pools of loans, such as consumer loans. Some banks are planning to run parallel calculations as soon as the first quarter of 2017.

Neekis Hammond, a principal with Abrigo Advisory Services, said it’s not surprising that many institutions rely on FICO scores to evaluate their consumer loans. What is unexpected, he said, is that almost a quarter of the audience wasn’t updating and storing any of the risk metrics on a more frequent, ongoing basis.

“It’s possible that the institutions in this segment are collecting it on a quarterly basis or maybe keeping only the most-recent snapshot,” said Neekis Hammond, a principal with Abrigo Advisory Services. “But given the forward-looking measures of CECL calculations, institutions will need data that allows them to more granularly measure credit risk and changes in risk over time. The metrics offered in the poll would be good proxies for credit risk in the consumer pool, where many small-balance loans can make up a significant part of the portfolio.”

More granular data will allow institutions to be strategic in their choice of methodologies and will provide more flexibility to ensure an accurate allowance calculation.

Institutions that determine their data is inadequate have several options for getting on track, including:

- Contacting the core provider and inquiring about data archiving

- Working with the institution’s internal IT department to create an in-house solution

- Working with a third-party, trusted vendor.

For more information on common data problems institutions are facing for the CECL transition and for immediate steps to ensure data needed for CECL calculations is accessible and sound, listen to the recorded webinar, “Data Quality Considerations for CECL Measurement.”