3 Risks Asset/Liability Management Addresses

Banks and credit unions face a seemingly never-ending array of financial risks, as the pandemic showed. From health-related surprises to natural disasters to terrorist attacks, the unexpected circumstances that can ...

Managing Financial Risk in a Post-Pandemic Environment

The piano can capture a variety of moods, depending on the musician at its seat. But even simple melodies from a finely tuned piano can tell a story. And when ...

Relating Fair Value and CECL: Misconceptions, Challenges, and Solutions

In just a matter of months, the coronavirus pandemic has had an unprecedented impact on the economy, upending financial institutions’ 2020 goals and business strategies. Now, banks and credit unions ...

CECL vs. Incurred Loss: How the Pandemic Affected the Allowance

In 2020, most SEC-filing institutions were required to move to the new current expected credit loss, or CECL, model. Following the 2007-2008 financial crisis, the CECL model aimed to provide ...

More ALLL Coverage

CECL Updates for Directors: 3 Topics to Cover with The Board

CECL updates for directors are critical for financial institutions transitioning to the current expected credit loss (CECL) standard in 2023 ...

3 Things to Know About Q Factors Under CECL

‘What will happen to Q factors?’ Want to know how to develop qualitative factors, or Q factors, under CECL, the current ...

Motivating 2023 Filers to Jump into CECL

The deadline for 2023 filers to transition to the current expected credit loss (CECL) model is rapidly approaching. Since the release of the CECL standard ...

Worried About the CECL Unknowns? Here’s What You Need to Know

For years, experts have emphasized the importance of preparing early for the implementation of the current expected credit loss (CECL) standard. CECL “analysis paralysis” has plagued many financial ...

Adopting CECL Accounting for 2023? 5 Myths about the Change

For financial institutions adopting the current expected credit loss, or CECL, accounting standard in 2023, the next 26 months will ...

CECL Methodology Implications for 2020 and 2023 Adopters

For years, financial institutions across the country have been preparing for the implementation of the new current expected credit loss ...

Latest Resources

Coronavirus and CECL: Novel Threats and New Accounting

The difficulty of containing the spread of the novel coronavirus (and the resulting disease, COVID-19) is putting pressure not only on human health, but also on delicate global social and economic networks. In this whitepaper, you will also learn how it is impacting CECL and other accounting standards.

CECL Methodologies: Pros and Cons for Your Loan Pools

Given that the CECL model is non-prescriptive, banks and credit unions have flexibility in choosing the right CECL methodologies for their institution’s unique data situation. This flexibility often leads bankers to one simple question: Where do I begin? In this complimentary infographic, learn about the 7 methodologies available to use and when they are or are not recommended.

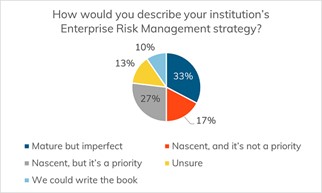

Integrated Risk Management | Leveraging Existing Practices to Drive Community Financial Institution Growth

This whitepaper will take a closer look at some of the existing risk management practices employed by financial institutions today and the areas of overlap and interaction between them. Additionally, it will consider ways to synthesize results across these practices and the case for automation to accelerate that process.

Tip Of The Day

Communication is key. It is important to have everyone on the same page in regards to the CECL transition status.

Poll

What type of data do you anticipate leveraging for your CECL calculation?

ALLL.com Insiders

CFO Corner — “ALLL” about CECL

In this occasional feature, CFOs from financial institutions share their approaches to the ALLL and to the CECL transition, as ...

The biggest initial impact of CECL on financial institutions

Most financial institutions understand CECL, and more specifically applying the CECL model to their loan portfolio, represents the most significant ...

Validating ALLL models under CECL – What might change?

What does model validation mean for the allowance for loan and lease losses and what will it mean under CECL? ...